Single Close Construction Loans in Auburn, AL

Building a home is fun but construction financing can be a nightmare. The Federal Housing Administration offers single close construction loans that are accessible to those with lower credit scores, making it easy and simple to finance both the construction and permanent mortgage of your dream home in one loan. Here we’ll break down the benefits of single close construction loans and why Bob Fabian is the man to talk to for this type of financing in Auburn, AL.

What is a Single Close Construction Loan?

A single close construction loan, also known as a “one-time close” loan, allows you to finance the construction of your home and convert it into a permanent mortgage in one process. Instead of having to take out two separate loans—one for construction and another for your mortgage—a single close construction loan lets you manage both under one roof.

Unlike traditional construction loans, which often require a 20% down payment, single close construction loans offer more affordable options, making them appealing to potential borrowers looking for lower down payment solutions. This eliminates the second closing which means you save on closing costs and avoid the hassle of multiple loan applications and approvals. Single close construction loans are popular with custom home builders and those buying new construction homes, they offer more security and simplicity than other loan types.

How Does a Single Close Construction Loan Work?

The process of getting a single close construction loan is simple but involves these steps:

- Pre-Qualification: Before construction starts you must be pre-qualified for the loan. This involves checking your credit score, income, debt-to-income ratio and financial history to make sure you qualify with the lender. Pre-qualification will determine how much you can borrow based on your financial situation. Additionally, it involves understanding the maximum loan amounts you can borrow based on your financial situation.

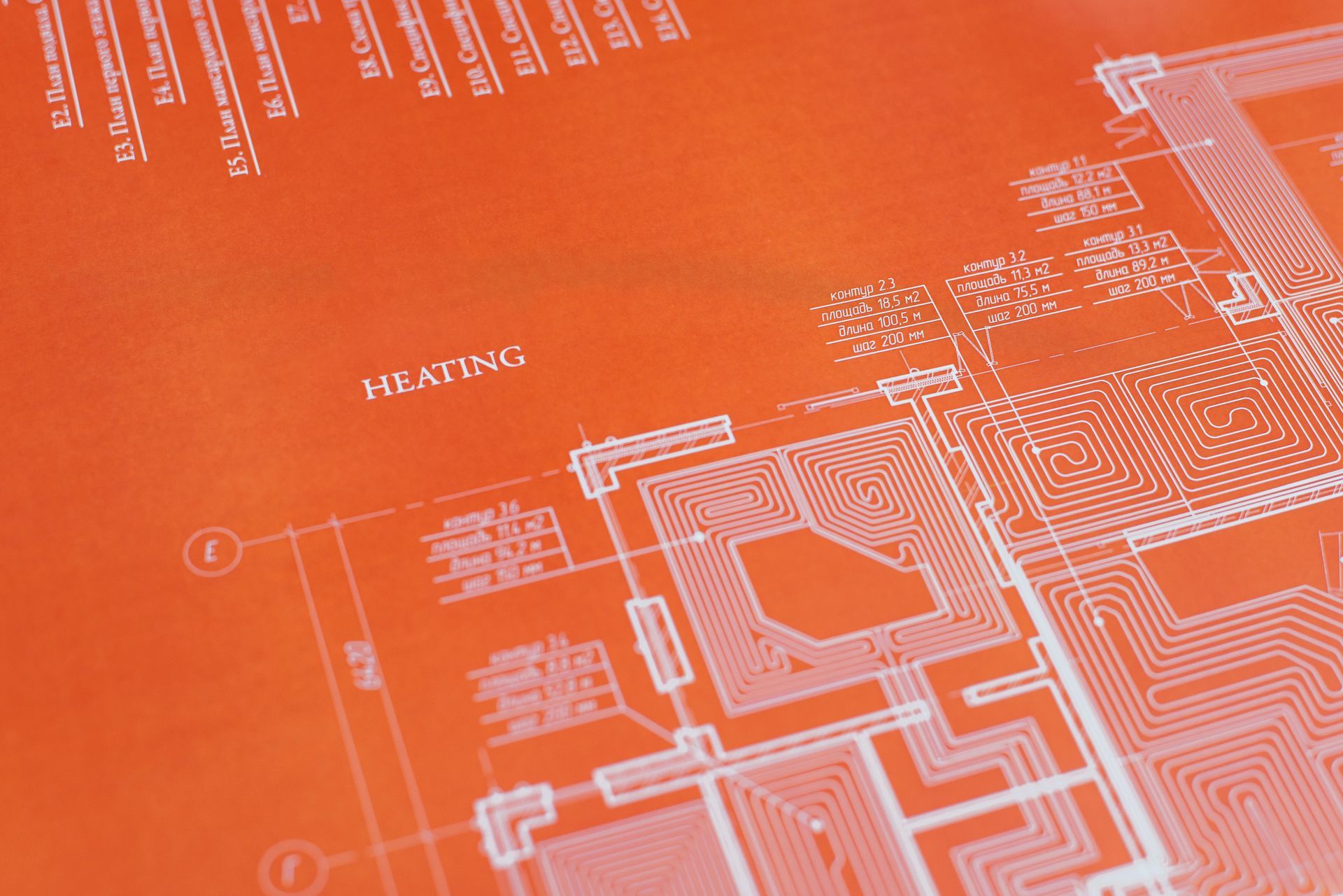

- Construction Plans: As part of the loan application, you’ll need to provide detailed construction plans and a contract with the builder. The lender will review the plans to make sure the project is feasible, and the builder has the necessary qualifications and experience.

- Appraisal: An independent appraisal will be done based on the plans and specifications of your future home. The appraiser will estimate the value of the completed home which is a big factor in determining the loan amount.

- Loan Approval and Closing: Once your loan is approved the closing process begins. Unlike traditional loans where you may have multiple closings (one for construction and one for the permanent mortgage) the single close construction loan consolidates everything into one event. After closing construction can start.

- Construction Phase: During the construction phase funds are disbursed to the builder in draws or installments based on the work completed. The lender will monitor the progress of the construction to make sure everything is going according to plan and budget.

- Transition to Permanent Loan: Once construction is complete and the final inspection is done the loan converts automatically into a permanent mortgage, either fixed rate or adjustable-rate loan depending on the terms. No need for another loan application or closing process, you save time and money.

Single Close Construction Loan Benefits

- One Loan, One Closing: The biggest benefit of a single close construction loan is one loan, one closing. This saves time, reduces paperwork and makes the process more streamlined. You don’t have to juggle multiple applications, approvals or closings, making the journey from groundbreaking to move in much smoother.

- Fixed Interest Rate: Since you lock in your interest rate during the construction phase you don’t have to worry about rates going up after the house is built. This gives you peace of mind knowing your monthly payments will be the same. For many homebuyers the ability to get a rate early on is a big relief especially in a rate environment.

- Convenient Draw Schedule: During the construction phase the builder is paid through a draw schedule where funds are released at different stages of construction. This ensures funds are distributed properly, protects both you and the lender. The draw schedule allows for better financial management, so each stage of the home’s construction is completed on time and within budget.

- No Need to Re-Qualify: Another great benefit is you don’t have to go through the qualification process again after the home is complete. Once you’re approved for the single close construction loan it converts into a permanent mortgage once construction is finished. This is big for borrowers who worry about changes in their financial situation during the construction phase.

- Reduced Closing Costs: With one closing you reduce the number of fees and closing costs compared to taking out two separate construction and permanent loans. This can save you thousands of dollars in unnecessary expenses which is especially important when managing a construction budget.

Eligibility Requirements

To be eligible for a single close construction loan in Auburn, AL, borrowers must meet specific criteria. These requirements ensure that you are financially prepared to undertake the construction and mortgage process. Here’s what you need to qualify:

- Minimum Credit Score: For FHA and VA loans, a minimum credit score of 640 is required. Conventional loans typically require a higher score, around 680 or more. This ensures that you have a solid credit history and are a reliable borrower.

- Debt-to-Income Ratio: Your debt-to-income ratio should be 50% or less. This ratio compares your monthly debt payments to your monthly gross income, ensuring you can manage additional loan payments.

- Down Payment: Depending on the loan program, you’ll need a down payment ranging from 3.5% to 5% of the total loan amount. This initial investment shows your commitment and reduces the lender’s risk.

- Stable Income and Employment History: Lenders look for a stable income and employment history to ensure you can make consistent loan payments. This typically means having a steady job for at least two years.

- Identification and Social Security Number: Valid identification and a social security number are necessary for the loan application process.

- Property Appraisal and Inspection: A property appraisal and inspection are required to confirm the property’s value and condition, ensuring it meets the lender’s standards.

Meeting these requirements is crucial for securing a single close construction loan. It’s always a good idea to discuss your specific situation with your lender to understand all the details and ensure you’re on the right track.

Auburn, AL Market Overview

Auburn, AL, is a vibrant and growing city, making it an excellent place to build your dream home. The presence of Auburn University significantly contributes to the city’s strong economy, providing stability and a constant demand for housing. The city boasts a diverse range of industries, including education, healthcare, and manufacturing, which further bolster its economic resilience.

The real estate market in Auburn is thriving, with a mix of new construction and existing homes available. The median home price is around $250,000, with options ranging from $150,000 to over $500,000, catering to various budgets and preferences. Auburn’s relatively low cost of living makes it an attractive option for homebuyers looking for affordability without sacrificing quality of life.

Auburn is also renowned for its excellent schools. Auburn City Schools consistently rank among the top school districts in Alabama, making it a great place for families. The city offers a range of amenities, including parks, restaurants, and cultural attractions, ensuring a high quality of life for its residents. Whether you’re drawn to the bustling city center or the serene outskirts, Auburn, AL, has something to offer everyone.

Why Single Close Construction Loan in Auburn, AL?

Auburn, AL is a great city to build in. Rich history, great schools and a strong sense of community, Auburn has small town charm with big city amenities. Whether you want to build in the country or in one of Auburn’s many neighborhoods a single close construction loan can help you make it happen.

Here are a few reasons why Auburn, AL is a great place to build:

- Strong Economy: Auburn’s economy is anchored by education, manufacturing and healthcare, so it’s stable for homebuyers. With Auburn University at the heart of the city the demand for housing is always strong.

- Affordable Land: Compared to other areas in the Southeast Auburn has relatively affordable land, so it’s a great place to build custom homes. Whether you want to be closer to nature or in the city center there are plenty of options.

- Family Friendly: Auburn is family friendly, great schools and plenty of recreational opportunities. Building here means investing in a community that values education, safety and quality of life.

- Growing Housing Market: Auburn’s housing market has been growing for the past few years, so it’s a great time to invest in a custom-built home. With a single close construction loan, you can lock in today’s rates and avoid the uncertainty of the future market.

- Unique Topographical Features: North Auburn is known for its rugged terrain, thick forests, high hills, and deep hollows. The elevation ranges near the Chambers County line contribute to Auburn's diverse geography.

- Educational Resources: The Auburn Public Library is a key educational resource, supporting both the local school system and the community's access to information and learning.

Why Bob Fabian for a Single Close Construction Loan in Auburn, AL?

When it comes to a single close construction loan in Auburn, AL Bob Fabian is the guy you want on your side. With over 1,500 mortgage transactions and years of experience with new construction loans Bob knows the process and will make it as smooth as possible for you.

- Construction Loan Expertise: Bob has years of experience with single close construction loans, specifically for custom home builders. He knows the Auburn market and the builders and real estate professionals in the area.

- Competitive Rates and Personal Service: Bob offers some of the best rates in the market and takes the time to understand your financial goals and tailor a loan to meet your needs.

- Client Education: Bob educates his clients throughout the mortgage process. First time homebuilders and seasoned investors alike will understand every aspect of their loan from application to closing so there are no surprises.

- Smooth Process from Start to Finish: Bob’s service is seamless. From application to closing he works closely with you and your builder to ensure timely draws, clear communication and a successful project.

- Local Expert: Bob knows the Auburn, AL real estate market. He knows the trends and regulations and has a network of local professionals to help you through the process.

- Proven Results: Over 1,500 mortgage transactions and a focus on new construction loans, Bob has a proven track record of helping clients achieve their home building goals. He has a reputation for excellence in the Auburn community.

Building a home in Auburn, AL should be fun and with Bob Fabian as your loan officer you can be sure your financing is in good hands. He knows single close construction loans and customer service.